See how Open Banking 3.0 is changing the approach to financial data, payments and security. Will the new regulations completely replace PSD2? Find out what challenges and opportunities await banks, fintechs and users in the new era of open financial services.

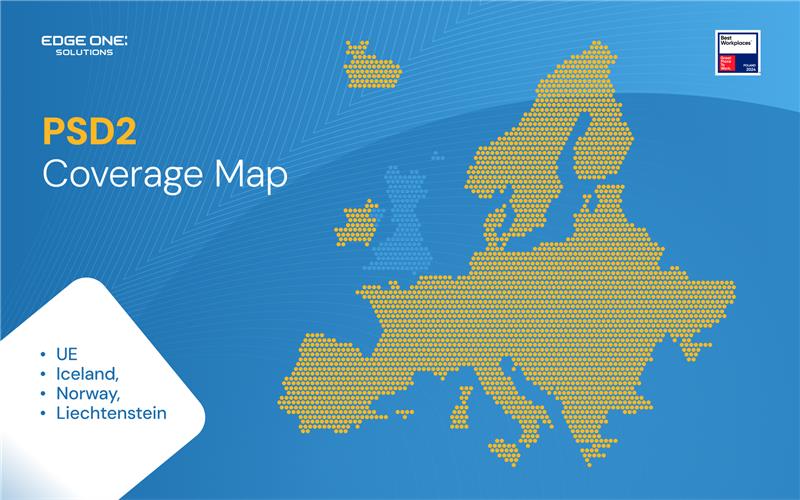

Remember how the PSD2 directive turned the banking sector upside down a few years ago? This inconspicuous regulation – Payment Services Directive 2 – covered the entire European Economic Area, i.e. the European Union, Iceland, Norway and Liechtenstein. Thanks to it, the foundation was laid for what we know today as open banking. PSD2 not only improved the payment system in the EU, but also opened the door to new financial technologies, which we in Poland have used exceptionally effectively. And who benefited the most? We, ordinary customers – because greater competition on the market translated directly into better offers.

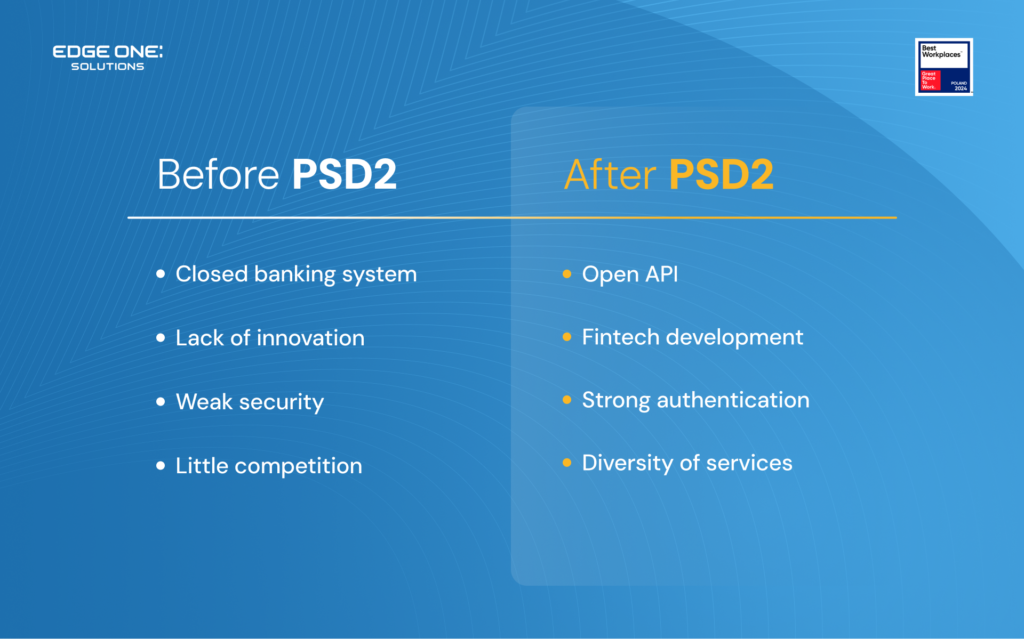

PSD2 is a real breakthrough – it changed ossified banking models and opened up space for innovation. By forcing banks to share data via API, the directive pushed them into the arms of new technologies and external partners. This is why we could observe the rapid development of fintechs and improvement of the security of our transactions. Today, when customer expectations are growing and technology is rushing forward, the traditional open banking model is evolving towards Open Banking 3.0. In this article, we will look at what PSD2 has changed, what new opportunities Open Banking 3.0 brings and what challenges the financial industry faces.

How did PSD2 affect banking?

PSD2 literally shook up the banking sector. It focused on increasing competition, transparency and security of transactions. Banks had to open their data treasures to external companies through standard APIs, which created space for completely new services. As a result, we, as customers, gained access to personalized offers, and fintechs could introduce innovations based on the analysis of our data. But PSD2 is not only about modern services – it is also a guardian of our security, which introduced strong authentication and dedicated protocols subject to regular checks.

Introduction of the obligation to share bank data using API

The key to the PSD2 revolution was forcing banks to share data via secure APIs. This standardization of communication between banking systems and external applications allowed for the integration of modern solutions processing financial data in real time. Companies such as Tink and TrueLayer have shown how APIs can build modern financial systems and create services tailored to our individual needs.

Thanks to this unification of the financial system, we can now track accounts from different banks in one place – doesn’t that sound tempting?

Development of fintechs and new business models based on open banking

Opening up access to data has become a catalyst for innovative fintech companies. New players have used the capabilities of PSD2 to create applications that help us manage our budgets, offer mobile payments or investment platforms. As a result, the financial market has become more competitive, and we have gained a wider choice of services tailored to our needs.

The best example of this development is our Polish BLIK system, based on 6-digit codes expiring after 120 seconds. This flagship solution, which we have been using for years, is only now entering international markets. Thanks to open banking, we can also easily set up prepaid cards or use multi-currency services such as Revolut.

Strengthening transaction security and user authentication

With the opening of banking data, increasing transaction security became a key task. PSD2 introduced mandatory two-factor authentication (SCA), which significantly reduced the risk of fraud. Modern technologies, such as biometrics and dynamic tokens, increase the level of protection of both data and entire transactions, building greater customer confidence in using financial services.

Thanks to PSD2, classic tokens and code generators are now a relic of the past. Login requires not only a password, but also a second factor verifying identity. Biometric data are increasingly used for this purpose – a fingerprint or a face scan.

Increased competition and transparency in the financial sector

The obligation to share data has made the financial market more competitive. We can now choose between traditional banks and new, innovative fintechs, which often offer better conditions, lower fees and faster access to information. Transparency of financial institutions’ activities has become a priority, which has had a positive impact on the entire industry.

Thanks to clear guidelines that apply to all financial entities, regardless of their size, we do not have to worry about the security of our data and money. It is worth remembering that the financial sector is one of the most regulated sectors of the economy.

Examples from the markets

To better illustrate the impact of open banking, it is worth citing some well-known examples from different regions:

Europe

The first PSD directive was introduced to the market 18 years ago. Thanks to this early response, the European financial market is much more developed than, for example, in the United States. Fintechs such as Revolut, N26 and Starling Bank have introduced innovative solutions that allow us to manage our finances fully mobile. Integration with open APIs has allowed them to offer services distinguished by low fees and an intuitive interface.

Some services go a step further – they no longer allow you to log into your account via computer. Financial services based solely on applications are becoming increasingly popular. Lower production and service costs translate into better conditions for us – end customers.

North America

Companies cooperating with API platforms, such as Plaid, have revolutionized the way users connect their bank accounts to financial applications. As a result, it has become possible to create solutions based on real-time data analysis, which has significantly improved the quality of services. Thanks to the availability of API, it is possible, for example, to analyze expenses incurred on subscriptions paid in a monthly model.

Other markets

Countries such as Australia, Canada, and Singapore are implementing similar open banking standards, which contributes to the globalization of trends. Local fintechs and international corporations are increasingly using open APIs, which allows them to create comprehensive financial solutions tailored to the specifics of a given market.

Global perspective

The development of open banking and the significant digitalization of the financial sector have naturally encouraged big tech companies to invest. Giants such as Apple and Samsung cooperate with the financial sector, offering their own services, such as Apple Card in the US or Samsung Pay payments.

Open Banking 3.0 – a new stage of evolution

Expanding access to data

In the era of Open Banking 3.0, data sharing goes beyond ordinary bank accounts. Information from the insurance, investment and other financial sectors is increasingly being integrated. This expanded data availability allows for the creation of more comprehensive and personalized offers.

Today, we can buy motor or travel insurance from the banking application on our smartphone. More and more financial institutions are launching their own loyalty programs to attract and retain customers.

Greater personalization of services

Thanks to advanced data analysis, it is possible to match offers to our individual expectations even more precisely. Big data techniques allow us to analyze our behavior in real time, which results in dynamic adjustment of products and services to current trends.

Financial applications react on an ongoing basis and inform us via push notifications. A large transfer has appeared in your account? You will probably receive a notification about a preferential deposit or investment offer.

Higher level of security

The new generation of solutions is based on the implementation of artificial intelligence (AI) and modern methods of user verification. Automatic systems for detecting anomalies, biometric identification methods and advanced data protection mechanisms are the foundation of an increased level of security.

Analysis of behavioral behavior in banking applications allows us to detect the activities of cybercriminals and protect us from losses. Different behavior, such as long browsing of history or multiple login attempts from different places, is enough for the system to block access.

Expansion outside Europe

Open banking standards, which were initiated by PSD2, are also gaining importance in global markets. In countries such as Australia, Canada and Singapore, we can see dynamic implementation of similar solutions, which contributes to the globalization of security and transparency standards.

Challenges for Open Banking 3.0

New regulations

As technology develops, the integration of financial systems progresses, generating the need for legislative changes. The financial sector is another example where the law does not keep up with technological possibilities. The key question remains what regulations will replace PSD2 and what their consequences will be for banks and fintech companies.

Privacy protection

The growing amount of available data poses challenges related to protecting our privacy. It is crucial to develop mechanisms that will allow for balancing access to information with maintaining the highest standards of personal data security.

System interoperability

The variety of API standards used in individual countries makes it difficult to integrate financial systems in a uniform manner. The challenge remains to create consistent standards that will enable smooth communication between different platforms and institutions on an international level.

Building customer trust

To be more willing to use new fintech solutions, it is necessary to build lasting trust. Transparency of actions, effective security and education in the field of new technologies are the foundation that allows us to convince to use open banking.

Open Banking – what can we expect?

Open Finance

The Open Finance concept also includes investments and insurance. This allows customers to benefit from comprehensive financial services, integrated on a single platform, which makes it easier to manage personal finances.

Development of embedded finance

Embedded finance is the integration of financial services directly into e-commerce applications, social media, and other digital platforms. Examples such as Amazon Pay or Shopify Payments show how easily we can make transactions and manage finances without having to use traditional banking systems.

Impact of AI and Big Data

Real-time data analysis, supported by AI and big data technologies, will enable even more precise matching of offers to our needs. Dynamic recommendation systems and automation of decision-making processes are the key to future innovations in the financial sector.

Open Banking 4.0?

The question of the next evolution of open banking is already arousing interest among experts. It is possible that the next step will be Open Banking 4.0 – deeper automation and even greater integration of systems within the global digital economy. Technologies such as blockchain or the Internet of Things (IoT) could revolutionize the way financial institutions operate around the world.

Summary

The world of finance is changing faster than ever. Banks, fintechs and regulators must work together to provide us with even better, safer and more accessible services. The transformation initiated by PSD2 has not only changed the way banks share data and ensure the security of transactions, but has become the foundation for the dynamic development of fintechs and modern business models.

Open Banking 3.0 opens up new possibilities by expanding access to data, greater personalization of services and raising security standards. Given the challenges related to new regulations, privacy protection and interoperability of systems, building our trust as customers remains crucial.

The future of the financial sector, with concepts such as Open Finance, embedded finance and the potential Open Banking 4.0, heralds further breakthroughs in the global digital economy. And you, are you ready for this financial revolution?